Infrastructure Development Finance Company (IDFC) provides financial assistance to projects in roads, power, ports and telecommunications. Its subsidiaries offer a gamut of services that include project finance, asset management and investment banking. IDFC acquired Standard Chartered’s mutual fund business last year and completed the acquisition of SSKI’s institutional broking and investment banking business recently. These acquisitions have helped it achieve a robust and diversified business model. In the wake of upcoming infrastructure projects and better economic growth, IDFC is well-positioned to exploit the potential opportunities.

Business performance. IDFC’s diverse income stream can broadly be divided into interest income and non-interest income. Interest income is from infrastructure projects and treasury while non-interest income comes from asset management, investment banking and other services. As of Q1FY10, both the segments contributed almost equally to the revenues.

With credit offtake slow earlier this year, non-interest income has helped IDFC maintain good growth and a high return on assets (2.5 per cent). Also, asset management fee formed more than 30 per cent of the non-interest income, boosting stability. IDFC’s assets under management (AUM) have grown from around Rs 12,000 crore last year to over Rs 23,000 crore now.

IDFC ramped up its treasury book as infrastructure revenues fell, which helped it maintain net interest income (NII) growth in Q1FY10. The advances book (over Rs 20,600 crore in FY09) comprises projects from energy, transport, telecom, real estate, cement and steel sectors. With infrastructure spending likely to exceed $500 billion for the Eleventh Plan, the company’s exposure to road and power projects offers immense revenue potential.

IDFC has healthy capitalisation ratios of over 20 per cent. Aiming for modest loan growth of about 15 per cent in FY10, it should be able to maintain them. With a sizable fixed income treasury portfolio, it has adequate liquidity for its operations.

Financial performance. In FY09, IDFC’s operating income grew 31 per cent y-o-y while NII surged by over 30 per cent.

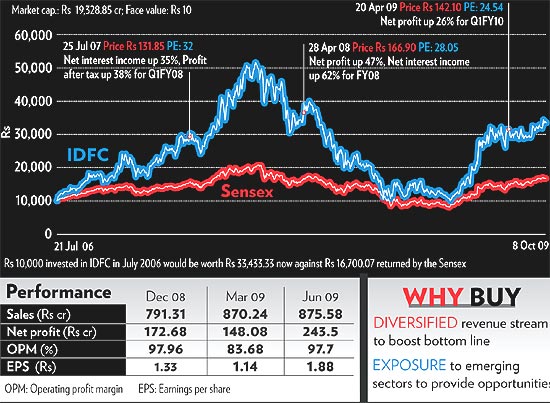

Operating income increased 12 per cent y-o-y in Q1FY10, although loan growth contracted. Net profit increased 26 per cent. The strong 14 per cent growth in NII and 32 per cent rise in non-interest income were the other highlights of Q1FY10.

IDFC has been consistently maintaining excellent asset quality with non-performing assets (NPA) near zero. Although the loan book grew by a marginal 4 per cent, with infrastructure investments expected to increase in future, it should not witness much pressure.

Valuation. IDFC’s impressive results recently have led to a run-up in the stock price, which has almost doubled in the last six months. It is currently trading at a PE of 26, higher than that of its peers. PFC is trading at a PE of 16 while IFCI is trading at 6. However, several factors make IDFC attractive even at this level, the main being its non-interest income. As interest rates harden, income from acquisitions will help cushion its bottomline. Another factor is the extension of takeout financing (financing long-term projects with short-term loans; second lender takes over loan after a pre-decided period and pays the first lender), which can help in addressing the asset liability mismatch. Other factors include upcoming infrastructure projects and better credit offtake.

With the government’s thrust on infrastructure development remaining high and credit demand likely to pick up, IDFC looks like a definite growth story. Buy in small quantities to take advantage of any short-term market correction.

No comments:

Post a Comment