Four months in the crucible and Madhu Kannan, the new CEO of the Bombay Stock Exchange (BSE), has already figured out where to find solace. “Have you seen the price of BSE shares,” he asks, on the sidelines of a seminar organised by BSE. “It has jumped almost 50% in the last four months.” It is a poignant state of affairs: these days, any hope of the BSE regaining even a vestige of its former glory, hangs on threads as flimsy as a recovery in the grey market.

But, it is only natural for the US-returned Kannan to think like an American CEO. In his previous job, he was an MD in the corporate strategy group of Bank of America-Merrill Lynch in New York

|

Over two years have gone by since the 790 brokers, who owned 100% of the 134-year-old exchange, pared their holding to 49%. A bunch of 21 diverse investors picked up the 51% equity. By then BSE had become a bottom line-oriented entity. On paper, the demutualisation of BSE—or separation of those who own and run the exchange and those who trade on it—is complete. But, in reality, the exchange is yet to be fully delivered from broker-members.

Broker-members routinely interfere in exchange management. In the past, they have allowed professionals little freedom

|

***

Shootout

BSE lags behind its rival NSE in both turnover and in market share.

| Financials | NSE | BSE |

| Transaction Income | 746 | 110 |

| Revenues | 1,039 | 420 |

| Expenses | 304 | 224 |

| PAT | 521 | 179 |

| Market Capitalisation* | 49,75,799 | 52,85,658 |

| Turnover* | 3,64,415 | 1,22,319 |

| Companies Listed* (in numbers) | 1,431 | 4,942 |

| Market Share (including F&O)# | 93 | 7 |

*as on August 2009; # in % as in FY09. Financial result as in FY2008; turnover in the cash segment; figures in Rs crore unless otherwise mentioned. Source: WEF, Company

***

Consider this: no matter what the board decides, it still has to go back for shareholder approval. “BSE is a theoretical demutualisation; powers still rest with non-professionals,” says a source. Brokers still hold 47% (as on July 2009) of the exchange’s equity and never shy away from using the clout. They also control a fourth of the 11-member BSE board.

“They (the broker-members) still interfere in every thing. They often surpass senior management and access information from the exchange,” says the former board member. “They always wanted to be a closed boys club,” adds Rashesh Shah, Chairman and CEO of Edelweiss Capital, a Mumbai-based financial services firm listed on the stock exchange, referring to brokers viewing BSE as their exclusive fiefdom.

Strong Lobbyists

At the heart of the problem is a conflict of interest between the broker-members and the exchange. Insiders say that broker-members are always looking to protect their short-term interests, and are not far-sighted to have a larger vision for BSE.

One example is in the area of market-making—used to improve liquidity in the exchange. BSE tried to rope in market makers four times between 2001 and 2008. But it failed the first three times because broker-members insisted that market-making contracts be given to individual brokers (part of their club) and not to institutions.

It took off the fourth time, only to be tripped up soon after. In 2008, BSE made a departure and appointed corporate brokers Apollo Sindhoori in Hyderabad and SAM Global Securities in Delhi as market-makers in the Futures and Options (F&O) market. Improving liquidity helped attract more investors and enabled them to strike more trades. That pushed up BSE’s market share in the F&O segment from a mere 1% to 3%. The plan was to take this to 10% by 2010.

But that was when the broker lobby got into the act. The grapevine has it that they forced former CEO Patel to step down because he had paid Rs 50-75 crore to the brokerage houses for market-making. “Brokers did not like BSE spending money. They see the BSE as their personal property and not as a business,” confirm sources. In fact, as CEO, Patel had authority to spend only Rs 10 lakh on business development.

“There were times when BSE asked us to create market for their products and that too without compensation,” says Hemang Jani, Senior Vice-President, Sharekhan, a Mumbai-based brokerage firm. “No one has time to do service for free.”

Similarly, capital expenditure spends created a controversy. When the BSE spent Rs 6 crore to pick up a 5% stake in The Calcutta Stock Exchange (CSE) and awarded a Rs 125-crore technology contract to OMX—a Swedish IT company that provides exchange technology to 60 exchanges worldwide—the lobby went to work again. The contract was rolled back. SM Datta and Jamshyd Godrej resigned as independent directors of BSE. Reports in the media quote Datta stating that he quit because his honesty and integrity were questioned in the two deals. In the CSE deal, the BSE offered its trading platform to CSE stock brokers, who could now do business with BSE directly, rather than being a sub-broker of a BSE member. This affected the Kolkata business of some prominent BSE broker-members.

Lost Opportunities

The BSE has also built up a track record of announcing acquisitions, but not going ahead with them. To start with, it signed a memorandum of understanding (MoU) to pick up 26% in the National Multi-Commodity Exchange (NMCE) for Rs 26 crore in February 2008. But it later backed out. Before this, BSE had talks with Multi Commodity Exchange (MCX) for acquiring 10% stake in it. This too didn’t happen. Similarly, BSE backed out of a tie-up for launching a spot bullion exchange with Bombay Bullion Association and Reliance Money. BSE has reserves of over Rs 1,700 crore, but it has consistently missed opportunities.

***

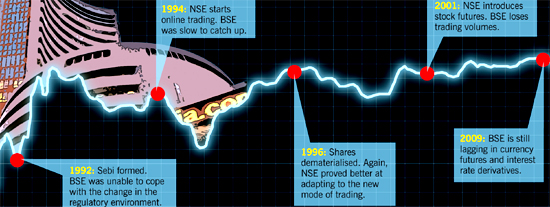

The long road downhill

***

Here is another such example. BSE offers depository services through Central Depository Services (CDSL), in which it holds 36.6% equity. It also offers clearing and settlement through BOI Shareholding, in which it holds 49%. These earned it dividends of Rs 4 crore, from CDSL in 2009 and Rs 1 crore, from BOI Shareholding in 2008. Here again, the BSE board’s plan to invest more in these companies was shot down by the members.

BSE has also lost out to NSE in the F&O race. BSE was the first to introduce index-based futures in June 2000. But in November 2001, NSE started individual stock futures, a more efficient substitute for the badla—the stock carry forward system that was then popular on BSE. That was when NSE volumes first surged past BSE. Since then, NSE has built a near monopoly in the equity exchange business. “BSE was not prepared to accept the change in the system—be it the establishment of a regulator, emergence of new players, technology or newer products,” says Edelweiss’ Shah.

***

Top five BSE Shareholders

| Shareholders | (%) |

| Deutsche Borse AG | 4.95 |

| Singapore Exchange | 4.95 |

| State Bank of India | 4.95 |

| Life Insurance Corporation of India | 4.95 |

| Dubai Financial | 3.96 |

Note: Today 51% stake of BSE is in the hands of 21 investors, while the rest is with brokers.

Source: IDFC-SSKI

***

“The other problem with the BSE is their clientele,” says a source. Most of their clientele are brokers who do not deal in currency and interest rates, and, therefore, newer products like currency derivatives have been a big failure, despite BSE getting the first mover advantage. “Banks and institutions that use such products are staying away from BSE,” he adds.

BSE is now having a second go at the currency derivatives segment. It has acquired 15% in United Stock Exchange (USE) for Rs 22.5 crore. Says TS Narayanasami, MD & CEO, USE: “BSE will concentrate on equity and equity derivatives. We will focus on currency and interest rate derivatives.”

USE is expected to launch its exchange in the next two months. BSE will provide the technology platform, while USE will do the marketing of the exchange. They are betting on the 16 public sector banks that are stakeholders in the exchange to boost volumes. But, here too, a few eyebrows were raised over why BSE paid Rs 22.5 crore when it’s going to offer its IT platform to USE.

***

How it adds up

| BSE's Income | 2009 | 2008 | 2007 |

| Trading Members | 124 | 172 | 111 |

| Investment & Deposits | 222 | 175 | 81 |

| Services To Corporates | 29 | 42 | 30 |

| Training Institute | 7 | 6 | 4 |

| Income From Other Services | 39 | 25 | 22 |

| Total Income | 421 | 420 | 248 |

| Total Expenditure | 155 | 224 | 148 |

| Profit Before Tax | 266 | 200 | 100 |

| Profit After Tax | 212 | 179 | 91 |

| Earning Per Share (Rs) | 19 | 198 | 108 |

| Paid-up Equity Share Capital (Face Value Re 1) 1 | 0.24 | 0.78 | 0.69 |

| Reserves | 1,718 | 1,558 | 1,005 |

Note: Results ending on March 31. Figures in Rs crore, unless otherwise mentioned.

Source: BSE

***

Not surprisingly, BSE has steadily lost ground to arch-rival NSE in the last few years. The newer exchange now boasts of 93% of market share. NSE’s net profit of Rs 521 crore (FY2008) is almost thrice as much as BSE’s Rs 179 crore.

The Slide

The slide started in 2001 when BSE had a net profit of Rs 53 crore and NSE Rs 68 crore. It could be attributed to two big developments. First, some by popular misconception, hold rogue-trader Ketan Parekh responsible. But it was the Anand Rathi episode that really triggered the downfall. In 2001, Rathi, a broker and, also the BSE President, was accused of colluding with Atul Tirodkar (who headed BSE’s finance and surveillance departments) and using sensitive information for insider trading. The charges against Rathi did not stick and he was cleared in October of that year. But, by then, BSE’s credibility had eroded. It was then that institutions like Infrastructure Leasing & Financial Services, Unit Trust of India and Infrastructure Development Finance Company reportedly took a policy decision not to trade on BSE. Since then, BSE has been losing volumes to NSE.

“The basic principle for any exchange is faith and transparency,” says a source. “The Rathi incident saw players losing confidence in BSE.” Adds Sharekhan’s Jani: “To this day, BSE has not been able to make a comeback from the crisis of 2001.” A Mumbai-based broker alleges that he is never sure of confidentiality when it comes to large transactions on BSE. But he has no such fears on the NSE.

“Market structure and governance are both important for an exchange. BSE is trying to put its market structure (introducing bulk deal window, charging separate transaction costs for active and passive traders) in place. But the other wheel—governance—is still an issue,” says a source.

But all is not lost yet. Despite losing ground, BSE still made a profit of Rs 212 crore in FY2009. Besides reserves of Rs 1,700 crore, it also has some good investments (CSE, CDSL and BOI Shareholding). Today, BSE earns 50% of its total income from its investments and deposits. As on FY2009, revenues from investments and deposits were Rs 221 crore, compared to a total income of Rs 421 crore. BSE also has offices on the exchange, and also owns two other properties around Dalal Street.

“BSE requires an anchor investor, who can take charge,” says an industry expert. But regulation doesn’t permit corporates or individuals to acquire more than 5% stake in it. “It’s a mindset problem. BSE should start afresh and brand itself in a fresh way,” says Edelweiss’ Shah. “BSE still has the potential to bounce back in a business environment that is expected to grow by 18%-19% in the next five years.” But newer rivals like MCX Stock Exchange will debut soon (See: MD and CEO, MCX, Joseph Massey’s interview). Kannan does not have much time to set the house in order.

No comments:

Post a Comment