Following are the Top 5 selected stocks:

Mahindra & Mahindra

The research undertaken by the author says that she is betting on the demand for Autos from the rural areas of India.

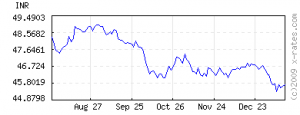

Further, she moves along with stock pick of M&M, as the company is a dominant player in the tractor market with 41% of the market share and also boasts of a smart portfolio of utility vehicles like Scorpio and Bolero. The company is also looking to diversify its business into non-auto businesses like IT and finance.

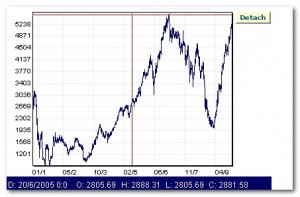

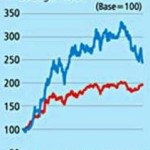

My View: Most of the automobile stocks, including M&M, have appreciated more than 3 times from their recessionary lows. Automobiles was the worst hit sector during the global recession, while at the same time it has outperformed the most, during the phase of recovery on the back of renewed consumer demand.

At the current market price of Rs.502/-, M&M has more than trebled from its lows of Rs.120 as on January 2009. After such a steep run-up, probably it could be a better idea for an investor to wait for the stock to correct somewhat and enter a consolidation phase.

NTPC

The second stock pick as per Wall Street Journal report is NTPC, based on the expectation of huge capacity addition in the power space of India over the next few years. Given the size and ownership of NTPC, the company is expected to grow at the same pace as some of the other new private players in the industry.

The stock is expected to grow along with the industry with its expansion plans on track. The research has placed an emphasis on the stock as a good defensive bet with healthy growth prospects.

My View: The Power sector has witnessed a flurry of action from a number of private sector players in the last couple of years. The supply side constraints in the power scenario for India have led to emergence of a number of private players to cater to this industry with ever-increasing power demand.

However, most of the new private companies which have tapped the public market to meet its funding requirements have come at rather steep valuations during their IPOs. To make the matters worse, most of these companies are yet to go through their investment cycle and wait-out due to long gestation period for most of their power projects.

Comparatively speaking, NTPC, which already has installed capacity and running operations, could well prove out to be a better bet in terms of current valuations at 19 times its earnings.

Bharti Airtel

The Wall Street Journal author Shefali Anand expects a lot of potential growth in subscriber numbers that is still remaining in the India’s telecom industry. Further, while backing the prospects of Bharti Airtel’s stock, the author confesses that the immediate future of this company continues to remain pretty cloudy.

However, the author emphasizes on long term investments with 5-7 years horizon until when the positive effects of consolidation in the sector could be more pronounced in nature. The company is also well-placed to benefit from the 3G revolution, the auction process for which has already kicked off.

My View: This is the stock pick with which I agree the most with the author of the wall Street Journal. Bharti Airtel, among with other telecom stocks, is currently quoting at depressed valuations on the back of adverse effects of stiff price wars prevailing in the telecom industry.

According to me, investments in Bharti Airtel seem to be the best bet among the large cap companies at current market valuations for most of the stocks. Post Africa’s Zain acquisition, the company is in a better position to diversify its revenue source and allay the fears of saturation in the Indian markets.

With ongoing 3G auction, Bharti Airtel could be the best bet for true long term investors with horizon of over 3 years of investment duration. The company is also expected to benefit the most from the implementation of Mobile Number Portability.

Federal Bank

The research has placed faith in Federal Bank based on the view that as the economy chugs with its growth, which will result in incremental borrowing for the individual business funding requirements. This aspect could lead to rise in the fee income of this bank. The author is also betting on the banks ability to control its NPAs.

The author has preferred to go with this bank as it has a sound presence in the southern India and that this bank itself could be an acquisition target by some larger bank wanting to cement its place in the South markets.

My View: Banking industry is said to be a mirror reflection of an economy’s health. Instead of Federal Bank, I would be tempted to go for few other Public Sector Banks like Bank of Baroda or Bank of India or even a small-cap bank like Indian Bank.

Bank of Baroda’s wide base has helped it to tap all the resources in rural, semi-urban and metro markets. Bank of India is estimated to notch around 15% earnings in FY10 and even higher over next one year.

Small-cap Indian Bank has witnessed a best turnaround over last few ears. This bank has performed well on all quality parameters. This bank boasts of NIM of over 3.5% in more than last 3-4 years. Its RoA at 1.6% in FY 2009 was the highest across all the banks.

J.K. Lakshmi Cement

From the allied infrastructure space, the author has chosen to go with J.K. Lakhsmi Cement as India chugs along with increased activity in areas of homes, roads, airports and other infrastructural projects where cement is predominantly used in structural works.

The cement stocks have registered a sharp gain in the previous year and have witnessed a bearish trend around this year due to rising raw-material costs of coal and large supply overhang. The author has further cautioned investors about the volatile ride in this small-cap counter.

My View: Rather than hand picking this cement company, the author could have directly gone for a good infrastructure company with niche presence in certain specific segment. Currently the cement industry is passing through the phase of glut.

My pick from the infrastructure industry would be Patel Engineering which is one of the leading players in the construction segment mostly concentrated in hydro power projects. The company also has mild presence in irrigation and road projects.

To name one another company from the infrastructure space, Hindustan Construction Company, with interests in construction of power, road and bridges, dams and marine works among other business operations. The company was also involved in construction of the famous Bandra-Worli Sea Link in Mumbai and is now involved in a premium hill station project of Lavasa

My Top 5 Stock Picks

Currently, most of the front line stocks are more than fair valued. Hence, my stock picks at current market valuations would involve a blend of large-cap and mid-cap stocks both. In fact, some of the mid-caps are still trading below their book value and could pick up pace as market advances and investors starts surfing for under-valued counters:

With the

With the